As a long time vendor to the medical device industry, Fishman® Corporation supports the efforts of the Medical Device Manufacturers Association, the Medical Imaging & Technology Alliance (MITA) and the Advanced Medical Technology Association (AdvaMed) to repeal the onerous medical device tax that threatens U.S. jobs, medical innovation and patient care.

As a long time vendor to the medical device industry, Fishman® Corporation supports the efforts of the Medical Device Manufacturers Association, the Medical Imaging & Technology Alliance (MITA) and the Advanced Medical Technology Association (AdvaMed) to repeal the onerous medical device tax that threatens U.S. jobs, medical innovation and patient care.

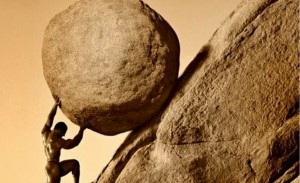

Here we have a thriving manufacturing segment that is fully regulated, already pays 29% in federal income tax, creates 1000s of jobs, invests huge amounts of $ back into R&D and employee education, contributes to their communities, particpates in countless charities linked to health care, manufactures the best products in the world, not to mention, products that save lives, and our government wants to bring it to its’ knees with an unnecessary, tremendously burdensome excise tax? Why? Is there some other thriving manufacturing segment that they are going to slip in to take its’ place in our teetering ecomomy ?

To quote from Medical Device Manufacturers Association website ; A broad coalition of medical technology companies, physician groups, venture capital firms and leading associations recently submitted a letter to Senate leadership urging policymakers to repeal the onerous medical device tax that threatens U.S. jobs, medical innovation and patient care. were among the 805 signatories that represent hundreds of thousands of medical technology jobs. Beginning January 1, 2013, the health care law will impose over $30 billion in new excise taxes on medical technology companies.

In coordination with the coalition letter, during November more than 50 executives from across the United States representing the two million that work for and support the medical technology industry will meet with members of Congress to encourage them to protect research, development, investment and innovation by repealing the excise tax.

“Without action from Congress, implementation of the medical device tax will cost our economy thousands of high paying jobs,” said Gail Rodriguez, Executive Director of MITA. “These job losses will directly impact patient access to the most advanced, life-saving medical technologies available.”

Employing more than 400,000 workers nationwide, the medical device industry generates approximately $25 billion in payroll, pays out salaries that are 40 percent higher than the national average ($58,000 vs. $42,000) and invests nearly $10 billion in research and development (R&D) annually.

“This damaging tax will force job cuts and investments in tomorrow’s treatments and cures,” said Stephen J. Ubl, President and CEO of AdvaMed. “Continued medical innovation is key to driving public health gains by reducing costs associated with chronic diseases like diabetes and obesity and catalyzing economic growth through healthier more productive people and by creating high quality manufacturing jobs. Simply put healthier lives mean healthy economies.”

The letter notes that the medical device industry is fueled by innovative companies, many of which are small businesses. In fact, 80 percent of them have less than 50 employees and 98 percent have less than 500 employees. The impact of the device tax is expected to be especially hard on smaller companies whose innovations are not immediately profitable.

Here is the letter;

Dear Majority Leader Reid, Assistant Majority Leader Durbin, Minority Leader McConnell, and Assistant Minority Leader Kyl:

As Congress explores policies to grow the economy and encourage job creation and innovation,we respectfully request that you add the repeal of the medical device excise tax to your list of priorities that should be acted on this year. We continue to believe that implementation of what was to be a $20 billion excise tax – and is now estimated to collect over $30 billion in taxes –will adversely impact patient care and innovation, and will substantially increase the costs ofhealth care. The House of Representatives passed repeal legislation by a strong bipartisan vote earlier this year. On behalf of the more than 800 undersigned organizations, associations,companies, patients, providers and venture capital firms representing hundreds of thousandsmedical technology jobs, we ask that you address the medical device tax before it goes intoeffect on January 1, 2013.

As you know, the medical device industry is a unique American success story – both for patientsand our economy. The United States is the world leader in manufacturing life-saving and life enhancing treatments, and the industry is an important engine for economic growth. The industry employs more than 400,000 workers nationwide; generates approximately $25 billion in payroll; pays out salaries that are 40 percent more than the national average ($58,000 vs. $42,000); and invests nearly $10 billion in research and development (R&D) annually. The industry is fueledby innovative companies, the majority of which are small businesses with 80 percent of companies having fewer than 50 employees and 98 percent with fewer than 500 employees.

Unfortunately, beginning in 2013, the health care law will impose over $30 billion in new excisetaxes on medical technology companies that will stifle innovation and U.S. competitiveness. Despite the 2013 implementation date, the tax is already having an adverse impact on R&D investment and job creation, jeopardizing the U.S. global leadership position in medical device innovation. If this tax is not repealed, it will continue to force affected companies to consider cutting manufacturing operations, research and development, and employment levels to recoup the lost earnings due to the tax. It will also adversely impact patient access to new and innovative medical technologies.

I received this from the Linkedin Medical Devices Group yesterday;

With the new national catchphrase, “fiscal cliff,” on everyone’s tongue, is there even a *chance* the tax could be repealed?

Cook Medical thinks so … if we make enough noise … and Cook sponsored a page at http://no2point3.com/editorials asking permission to share your contact information with reporters looking to put a human face on the tax.

When you sign, John Eckberg from Cook will send you a press packet, the Roth Capital study (which shows little promise for a wave of new patients resulting from the Affordable Care Act), and tips how to contact your local TV station and newspaper.

As recently as this morning, Mark Leahey, President and CEO of the Medical Device Manufacturers Association (MDMA), issued the following statement today regarding the Internal Revenue Service’s final rule for implementation of the 2.3% medical device excise tax: